Second Birthday

We had a great time in Nevada celebrating Robin’s second birthday with Nonna, Pappy, the Anti-Sara, Nanita, Marqueño, and Great-Grandparents Elsie, Betty, and Wayne. I took lots of good pictures…and then somehow I lost my camera.

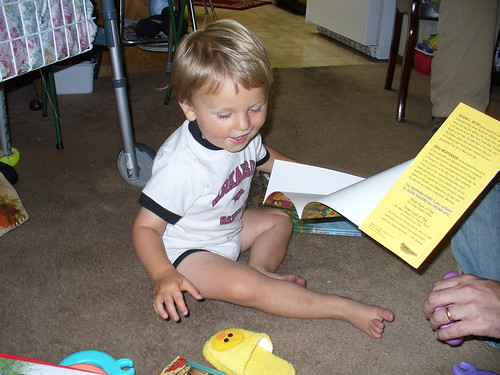

My mom sent me a couple of shots, though. Here, just on the edges of the picture, you can see the outskirts of the giant pile of presents that was brought for Robin. You can’t really see many of them, but you can see that he was happy and enthusiastic about investigating his gifts:

And here’s a shot of the Phillips menfolk, all together:

Mostly since we’ve gotten back we’ve been wrestling with the 203k process for our house. It’s unbelievably complicated and stressful. I wouldn’t recommend these loans, except that there really is no better way (at least for people who aren’t very skilled in construction work) to buy an older house and fix it up. DIY really wouldn’t be sufficient here—in fact part of the problem with the house is that it has suffered somebody else’s DIY efforts, all of which need to be ripped out and redone. And since lending standards have tightened, no bank would fund a conventional loan on a house in this shape anyway. So the 203k program is the only recourse for people like me who love older homes, but aren’t rich enough to buy one that somebody else has already renovated and is looking to “flip.”

Here is just one little part of the story: because these loans are funded through HUD, we are required to hire a HUD consultant in addition to our contractor. The HUD consultant basically gets paid for sitting around with his thumb up his butt for weeks, until the very last moment when he decides to throw a spanner in the works by insisting that our planned repairs will not satisfy HUD’s requirements. He says we have to get a very expensive soil engineer out to inspect the house’s foundation. This obviously causes more delay. Finally when the foundation inspection is complete, the soil engineer basically says “Well, yes, there’s some foundation cracking, which you would find in all older houses. It’s not about to fall down or anything.” HUD consultant insists that we repair the cracks. This adds $35,000 to the proposed scope of work. Sam and I weep and gnash our our teeth.

I don’t even have the stamina to recount all the other crap we’ve been dealing with in trying to close on the house. Suffice it to say that what started out as a $131,000 home that needed $25,000 worth of work is now a $131,000 home that needs $110,000 worth of work.

Obviously with each increase in cost Sam and I have been re-evaluating our commitment to this house. But the truth is that even a $250,000 home in this area is a very good deal (a one-bedroom condo in downtown Oakland goes for $375,000): and after all the work is done, it will be a lovely older home meticulously renovated, with the surface bits done to our exact taste.

There are still lots of things that can go wrong. The appraisal could come in low, requiring us to renegotiate the purchase price with the sellers. Also, the delays caused by the HUD consultant are going to force us to ask for an extension on the closing date: the sellers could refuse. Unexpected fees (like the soil engineer) are piling up, eating into our savings and making me worry about our ability to manage the closing costs. So, this thing is by no means a done deal and every day brings a new storm of stress. This is why I’ve been dodging questions about the house: I don’t really want to talk about it. I’ll let you know if something final happens, one way or the other.